Form 5472 can be considered a guide for the IRS to understand the global transactions of domestic and foreign related parties, and the penalty for failing to file Form 5472 on time is up to $25,000.

Form 5472 can be considered a guide for the IRS to understand the global transactions of domestic and foreign related parties, and the penalty for failing to file Form 5472 on time is up to $25,000.

A resale certificate is a signed document indicating that the purchaser intends to resell the goods and is usually provided by the retailer to the wholesaler.

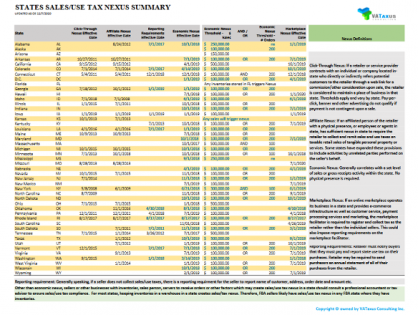

Take a look at our nexus definition summary, feel free to download for your own review.

Use tax is defined as a tax on the storage, use or consumption of taxable goods or services on which no sales tax has been paid. Learn more about difference between Sales Tax and Use Tax.

Simply put, sales tax compliance is just that - preparing and filing a sales tax return. We have broken down sales tax compliance into 7 steps.

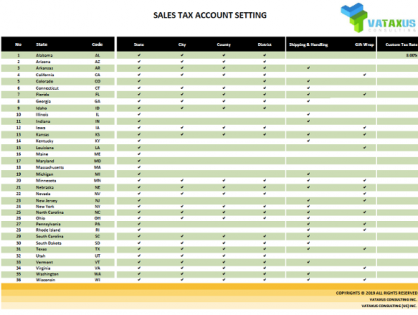

Learn more about Sales Tax Accounting Setting for US states.